2008 will be remembered for many things. It is the year when trillions have been poured into the world banking system which nearly collapsed under the weight of its own innovations. It is the year when the world’s largest economies entered recession. It is the year when the U.K. pound sank even below the Euro for the first time ever. It is also the year when a $50bn fraud case does not raise too many eyebrows. It would now appear that the main casualty of 2008 has been trust. The same trust that has been the foundation of banking industry for centuries. Lenders don’t trust other lending businesses any more. Investors don’t trust other investors. Customers don’t trust their banks or for that matter their government.

You might be wondering how this relates to subprime lending. Well, subprime lending came into existence because of lack of trust. Large banks did not trust certain individuals enough to take them on as customers and/ or to lend them money. In fact, studies have shown that half of UK’s adult population fell in this category. The reason may have been virtually anything – these people may have low or no income, they may have defaulted on previous loans, they may have moved house too often, they may be new to the country or even that they may not have any previous loans. The banks thought that if you had borrowed previously and made regular repayments, then you were a good borrower – no matter how much you owed. No one cared if you had managed your money well and never had the need to borrow. Such is the irony of a credit accustomed society. The cause is also simple – banks had enough “usual” or in other words prime customers to keep them profitable (yes, that’s what they thought) that they did not need to create new processes, checks and procedures to acquire and maintain “unusual” customers. Instead, they believed it to be simpler and wiser to invest in or lend to companies, either directly or indirectly, who lend to these “unusual” customers.

In enters the subprime lender. This lender works differently from the banks. He looks to align his operations to the subprime market. He can select those people with reasonable certainty who will repay their loans. “We know our customers in a way that is unrivalled elsewhere on the high street,” says Leo McKee, the CEO of BrightHouse. “Because we are very close to our customers we become aware of any change in circumstances very quickly. We can give them a payment holiday if they need it.” He adds, “There’s a huge market out here. We believe there may be as many as 10 million consumers in our target population.” And because he is making this extra effort to filter out the good from the bad as well as help them in their journey he deserves a premium on the loan he gives compared to loans from the banks. This also helps him make a margin on the loan that the bank has given him to lend to these people. This seems to works well if the lender keeps the risks and hence the credit checks. However, as soon as the risk is removed from the lender so are the incentives to keep the checks and the integrity of their processes. As anyone will now tell you, this is one of the main reasons for the current financial mess in the US.

The question remains – can you still trust the subprime customer? If you remove the issues that caused the crisis i.e. the delinking of risk and reward due to misaligned incentives, then the answer may still surprisingly be yes. You can take a look at examples like BrightHouse and Provident to see that money can still be made. What is now more difficult is to prove it to the investors and warehouse line providers. That is visible from some of the share price movements. Provident has swung between 963 pence/ share and 655 pence/share in the last year. Cattles has seen itself touch both 299 pence/share and 9.61 pence/ share in the same year.

What differentiates the real profit making subprime enterprises from the unprofitable ones? If you are thinking about it rest assured that you are not the only one. The FSA has thought about it as well. And they have thought about it very hard since Northern Rock became too heavy to remain afloat. You need to take a close look at FSA’s risk assessment framework, appropriately named ARROW (Advanced, Risk -Responsive Operating Framework), to see what I mean.

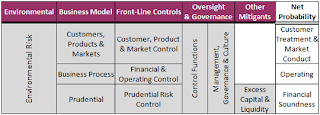

The ARROW risk model provides an overview of how inherent business risks, front line controls and governance arrangements interact within a firm or a group, leading to an overall assessment of net Risk. You will have risks because of the Environment and the Business Model. You can successfully mitigate or reduce these using Front Line Controls, Oversight Governance and by maintaining Excess Capital Liquidity. Based on this, ARROW has divided the different risks into 10 separate risk groups as can be seen below:

For each risk group, the FSA has also published a number of risk elements. For example, for the Environmental Risk Group the risk elements are: Economic Environment, Legislative / Political Environment, Competitive Environment and the Capital Market Efficiency. The credit crunch, which may seem to be a bolt from the blue for some of us, is none other than Capital Market In-efficiency. And it is interesting to know that the FSA has thought about this for a number of years. So why did no one foresee the Rock sink? It is because to calculate the overall risk, the risk probabilities and impact for each risk element are combined. A very low probability of occurrence of a risk event multiplied even by a very high possible impact may result in a very small overall risk which might fall off FSA’s radar. It will be of interest to understand the risk probability assigned by the FSA for the credit crunch.

What the ARROW model does achieve is to demonstrate that if you have the right amount of liquidity along with appropriate front line controls and governance you can manage your business risks. Good subprime lenders are those who can demonstrate that they understand their business risks and the market forces and have these controls and mitigants in place. A few subprime lenders are taking up this challenge. They are now focusing their efforts on putting in “visible” controls that can be audited by their investors and lenders. They are developing insightful management information that identifies the key business risks and the drivers of profitability in their portfolio. Attempts are being made to understand the impact of changes in economic and social environment on the portfolio mix and proactively change policies and pricing. Regular portfolio valuations are being conducted using prudent account level cash flow forecasts to understand and clearly communicate the real value embedded in the business. Moreover, traditional banking risk tools, like new business and secondary sales scorecards, are now being built and deployed in the subprime world to supplement existing decision making processes. Finally, these lenders recognise that building and deploying tools and reports is not the end game in itself. They are also redefining their oversight and governance frameworks by strengthening their operational audit teams and setting up risk committees that monitor the changing risk patterns on a regular basis.

Whether these efforts are sufficient to convince the heavily bruised investors and warehouse line providers is yet to be seen. But one thing is sure – the subprime lenders who are re-enforcing their risk management foundations will have an upper hand when the market mood swings. And in the meantime, if these subprime lenders are successful in implementing these crucial changes and start attracting new investments and cheaper warehouse lines, then they will not only survive but also flourish as the large banks merge and contract.

If you want to know more about the author or get in touch then drop an email to info@debtrecoveryguru.com. To read more articles like this visit www.debtrecoveryguru.com.